BY NT REPORTER.

A dealer has been with tax evasion charges and using fictitious names to claim tax refund.

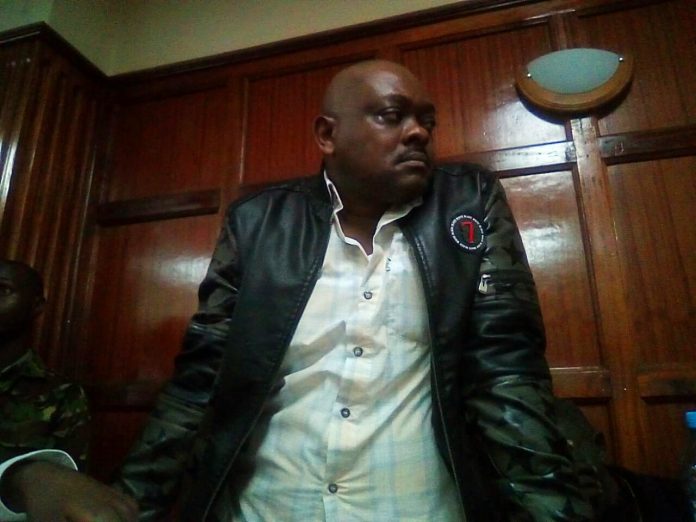

David Ngari Nderitu of Aberdare Solutions denied several counts when he appeared before a Nairobi court.

Nderitu is accused of omitting Sh 30,424,249 from his Value Added Tax returns for the January to December 2015 an amount which affected his VAT liability by Sh 4.8 million which ought to have been declared and paid to the commissioner by the VAT Act.

Nderitu who is the sole proprietor of Aberdare is also charged with omitting another Sh 74,576,378 from his VAT returns fro the year 2016 affecting his VAT liability by Sh 11.9 million.

In another count he allegedly omitted Sh 28,828,941from his VAT for the year 2019 which affected his VAT liability by Sh 4,612,630.

The proprietor is accused of claiming VAT refunds using fictitious invoices from Bosco Enterprises Sh 14, 032,035 knowing the claim to fraudulent and without merit.

He is also alleged to have unlawfully claimed VAT refund using fictitious invoices from Davron Petroleum Limited.

Chief magistrate Martha Mutuku ordered him to deposit cash bail of Sh 100,000 to secure his release.

The case will be mentioned on December 10, 2019.

According to KRA, Nderitu is a beneficiary of the “missing trader” tax evasion scheme, a tax fraud syndicate where a taxpayer uses several registered business names for fictitious invoicing but there is no actual supply of goods and services.