BY SAM ALFAN.

Six lobby groups have moved to court seeking to declare a man at the center of sex scandal unfit to hold public office.

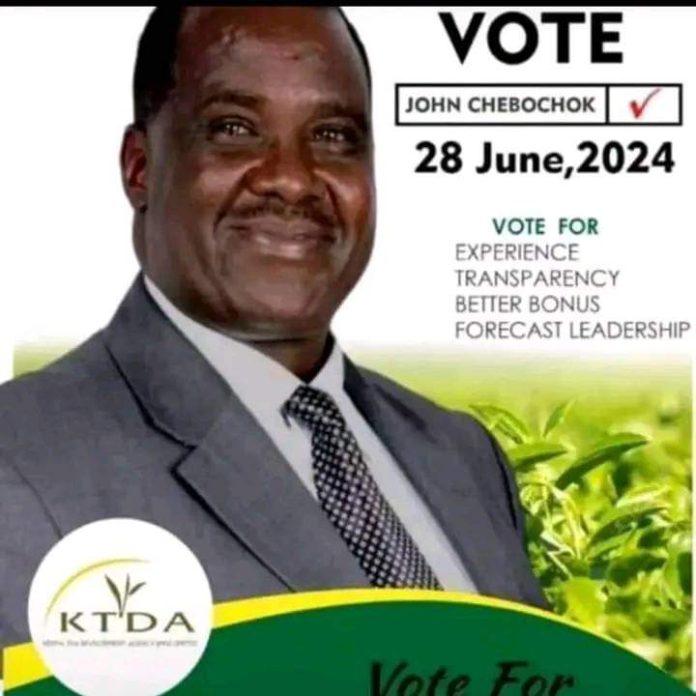

The lobby groups want John Chebochok, who was recently elected a director for Tegat/Toror Tea Factory, blocked from holding the position.

Last year, Chebochok was caught in a storm following an exposé by the BBC demanding sex from tea pickers, in abuse of his position and authority.

In the petition before the High Court in Kericho, the groups including Usikimye CBO, Wangu Kanja Foundation (k) Registered Trustees and Center for Rights Education and Awareness (CREW), also want the court to direct a probe into sexual exploitation in the tea industry.

Other organisations are OXFAM, the African Gender and Media Initiative Trust (GEM) registered trustees and Flone Initiative.

They lobby groups under certificate of urgency state that Chebochok is unfit to hold office and ineligible to contest for any public office.

Through lawyer Amazon Koech, the lobby groups seeks an order directing the Kenya National Human Rights and Equality Commission to investigate the systematic issues of sexual exploitation in the Tea Industry as per their mandate under Article 59 of the Constitution of Kenya.

“A declaration the decision by Tegat Tea Factory Limited , Kenya Tea Development Agency, Tea Board of Kenya and Independent Electoral and Boundaries Commission (IEBC) to clear Chebochok to contest for the Director of Tegat/Toror Tea Factory and the election of the IEBC to the said position did not adhere to the standards, values and principles set out in Articles 10(2), 26, 28, and 73 of the Constitution and is therefore unconstitutional, illegal and therefore a nullity,” lobby groups urges court.

They further seek the court to issue an injunction or conservatory order restraining the swearing of Chebochok into office as the Director of Tea Factory, Ainamoi Zone.

It is their plea that all candidates should meet the requirements under Chapter 6 of the Constitution.

“This is a Petition questioning the constitutionality of the clearance of Chebochok to contest for the Directorship of Tea Factory, Ainamoi Zone and election to the said position among other prayers a declaration that the Chebochok’s previous conduct violates the Constitution of Kenya particularly, Article 10, 26, 28 and 73,” says the lobby groups.

It is their argument that Chebochok’s previous conduct while holding a public office disqualifies from appointment or election to occupy any public office.

They argued that the conduct of Chebochok was totally reprehensible and ought not to be allowed to prevail but needs to be explicitly uncountenanced.

“This court should put an end to this lack of integrity in the public office,” says lobby groups through lawyer Koech.

Chebochok was exposed on the 20th February 2023 by BBC News Africa in their documentary titled “Sex for Work: The True Cost of Our Tea BBC Africa Eye,”.

The documentary revealed that he sexually exploited women who worked and those who sought employment at Finlays Company.

Koech said as shown on the BBC expose, Chebochok sexually exploited women who worked and those who sought employment at Finlays Company.

“This gross misconduct not only tarnishes the reputation of the tea industry but also inflicts severe harm on the victims, whose wounds remain unhealed. That as a result of the 1ª Respondent sexually exploiting women working and those who sought employment at Finlays Company he infected some of his victims with HIV/AIDS therefore risking their lives and health. This conduct by the 1” Respondent is a violation of the victims right to health as provided under Article 43(1)(a) and their right to life as provided under Article 26 of the Constitution of Kenya, “says the lobby groups.

The organizations add that sexual exploitation and Chebochok’s conduct amount to a violation of the victims’ right to not to be discriminated on their sex as provided for under Article 27 (4) of the Constitution of Kenya.

According to the lobby groups, the act of sexual exploitation of women violated the victims right to human dignity as provided for under Article 28 of the Constitution of Kenya.

“Similarly, the sexual exploitation conduct by the 1 Respondent to women working for Finlays company and those who sought for employment to work for Finlays company amounts to a sexual violence to the victims and is a violation of the women’s right not to be subjected to any form of violence as provided under Article 29(c) of the Constitution,” says the lobby groups in the court documents.

Further the sexual exploitation of women, presenting fake academic documents to the KTDA, Tea Board of Kenya -IEBC in order to be cleared to constest for the Directorship position by Chebochok to is a violation of the national values and principles such as upholding human dignity, equity, social justice, human rights and non-discrimination as provided for under Article 10 and 73 of the Constitution. 60.

“The victims have suffered permanent wounds and indignity, something the 4th respondent ought to and must answer and therefore at the very least it has to be interrogated whether in the light of the above, he is a person fit to hold a public office. “The nail needs to be hit right on the head”. Such a reprehensible conduct needs to be frowned upon and “buried or tossed out of the window” at the same time in a manner speaking to say that this shall not and will not be normalized because it makes a mockery of our Constitution and other laws and “was too bitter a pill”.

They argue that the clearance of John Chebochok by Tegat Tea Factory , KTDA , Tea Board of Kenya and IEBC to contest for the Director of Tea Factory, Ainamoi Zone and his election to the said position violates the national values and principles of governance provided for under Article 10 of the Constitution.

These values and principles provide a foundation upon which Kenyans have determined that our democratic state shall be build; they are the intestinal fluid which nourishes the bill of rights and the Constitution. Thus when making appointments to public office, every selecting, appointing and nominating authority must take into account these values and principles.

“The 2nd-5th Respondents failed to uphold the above article in clearing John Chebochok to contest for the Directorship of Tea Factory, Ainamoi Zone since Chebochok as per the BBC expose shown above is a man with no personal integrity, his decision making. while in office are based on sexual favours he receives from women employees, ” State lobby groups in the petition.

Th petition is supported by Usikimye CBO co-founder Njeri Migwi.

Law Society of Kenya, Association for Grassroot Journalists Kenya, Katiba Institute, Advocates for Social Change-Kenya, Independent Medico-legal unit, National Gender and Equality commission and Kenya National Commission on Human rights have been named as interested party.