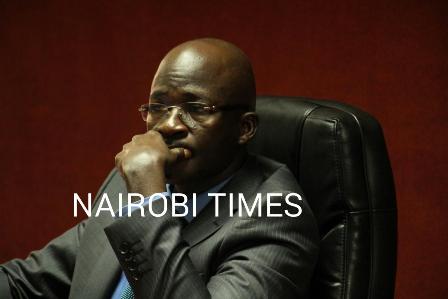

Justice Eric Ogola during the hearing of an application seeking his dismissal from hearing the commercial disputes touching on parties involved in the lucrative project Tatu City suit where he is accused of bribery on Tuesday October 13,10,2015.

BY SAM ALFAN.

High court will on Friday rule on whether the judge handling Tatu city suit will disqualify himself or not over bribery allegations.

This after the commercial judge admitted having discussed the Sh 240 billion Tatu City project with thirds parties, which now calls for his disqualification.

Justice Eric Ogola according to sworn affidavit by lawyer Issa Mansour , did admit before parties in the disputes indeed he had sought advice after receiving information that a complaint letter had been written to the judicial service commission.

Mr Issa told the court that he has on behalf of his client Christopher Barron applied for disqualification of the judge from hearing the matter.

Lawyer Denis Mosota for Anthony Njoroge who is the six respondents on the suit associated himself with submission by Issa Mansour saying the judge should disqualify himself from the matter since the application was raising weighty issues.

“The application and the affidavit filed in this court raises very serious and weighty issues” said Mr Musota.

Mr Musota further asked that, ”who is this fair minded observer” he cited a list of the authority that defined the meaning of the fair minded observer and asked the judge to withdraw from the matter to promote justice to the matter.

He said on 21 September 2015 when they came up for hearing, the judge walked to court visibly agitated and started ranting how he had been suffering because of a letter and accused an :” advocate” of taking instruction for the sake of money.

“The judge went on about twenty minutes and alluded to having discussed the case with unknown parties and was told that ” the person who authored the letter will come to court and engineer an application for re-excuse’ the court heard.

Mr Issa said that whether merits of the allegations in the dated 25 August 2015 and the complaint to the chief justice the admission by the judge to the effect that he had discussed the file with other parties is violation of the principles of judicial conduct.

He said that the admission itself is a good ground for recusal from the case, saying that the file should be placed before the presiding judge in the division to appoint another judicial officer to determine the commercial disputes between parties.

The tacit admission and the unwarranted attack on the advocate confirms that the the judge cannot impartially determine the subject matter before him, he said.

The lawyer submitted that it not clear whom the judge discussed the file with, is it the applicants, Tatu City, Rofinal company limited, Nashon Nyagah Vimalkumar Depar Shah or their advocates on record.

He questioned why the judge was did discuss the file with third parties when the matter still pending before him.

He says serious allegation have been raised which touches Sh 50 million bribery that changed hands to influence the outcome of the case.

Mr Barron applies that the judge re-excuses himself and the file be forwarded to the presiding judge of commercial and admirably division for re- allocation to another judge

The allegation contained in letter authored by Wilfred Gitonga of Kenyans and Justice and the same has been forwarded to the Chief Justice, Ethic and Anti- Corruption, Director of Public Prosecution, and commission for administrative Justice raises serious allegation over the handling of the commercial dispute.

Mr Barron says that he is apprehensive that there is real like hood of bias and confidence in the judge has been eroded in light of serious allegations raised by Mr Gitonga.

“Justice should not only be done but be seen to be done” he says.

When the mater come for on October 13, points of law will raised as part of the application for disqualification.

Last month Top consulting firm PriceWaterHouseCoopers (PWC) opted out from carrying out investigation into the accounts of Tatu City due to internal wrangle between the local and foreign partners.

Justice Ogola was told by PWC, that battle between foreign shareholders Rendearvour and their local partners Nahashon Nyaga and Vimal Shah have made it difficult for audit to be conducted as ordered by the court.

The firm says that shareholders have declined to execute document to pave way for the audit to commence.

Justice Ogola had ordered for the audit following a standoff between the shareholders on the actual position of loans taken purchase land for the project. PwC says that shareholders have not agreed on the terms of loan.

“The letter of engagement has not been signed by the parties. There appears to be hostility between the parties which may not allow us to proceed.

We are a professional body and some disparaging remarks have been made about PwC by one of the parties. We therefore seek to withdraw from the assignment,” PwC immense the audit, but did not get a go ahead to investigate the accounts.

The judge had given parties up September 23 to file an audit report on the offshore loan accounts, but the same has not been complied with

The court directed the parties to appear before him on October 1 for a hearing.

The audit report was intended to quantify how much money had been borrowed from the offshore financiers since the project started, and what balance is still owed to lenders.

Foreign partners

Stephen Jennings and Hans Jochum Horn had in an application alleged that Mr Nyagah and Mr Shah had good relationship with PwC and that there was likelihood for them to use their closeness to influence the outcome of the audit

The dispute has persisted since February and has slowed down the project. Mr Nyagah and Mr Shah alleged that the foreign partners them removed they manage the project alone

The foreign partners accuse their local partners for breach of contract by transferring land meant for the project.

.Consequently the (CID) has recommended for the arrest and prosecution of Mr Nyagah over an alleged action to defraud real estate of Sh5 billion.

Detectives investigating transactions involving the project’s subsidiaries have concluded that Mr Nyagah used close relatives and associates to irregularly transfer shares worth Sh5.3 billion, and has recommended that he and five others be charged in court.

Mr Nyagah and two city lawyers Nelson Havi and Edward Osundwa have obtained a court order stopping their arrest and prosecution.