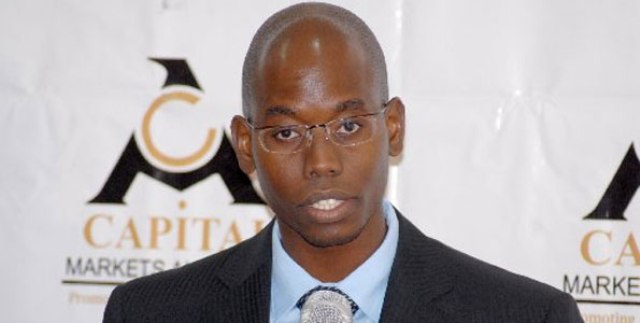

Capital Markets Authority (CMA) Acting Chief Executive Officer Paul Muthaura who unveiled a program that will see market players seeking a license from the authority undergo a test before acquiring the permit.

BY NAIROBI TIMES REPORTER.

Capital Markets Authority (CMA) has unveiled a program that will see market players seeking a license from the authority undergo a test before acquiring the permit.

Practitioners will be required to undertake and successfully complete the Securities Industry Certification Program (SCIP).

CMA Acting Chief Executive Officer Paul Muthaura said the introduction of a certification program in the country will ensure that practitioners in the capital markets industry have the requisite skills, operate with high standards and apply best practice as Kenya takes its positions as the hub of the African capital markets.

Speaking today at a Nairobi hotel during a certification forum, Muthaura said the program will further create a highly skilled talent pool as aligned to the capital markets master plan, the ten-year blueprint.

“For Kenya to be competitive and attract international funds flows ,key staff in capital market intermediaries need to adopt international certification standards to support the introduction of more diversified products in the markets as a well as to ensure that engagement with investors is consistent and to the highest possible standards,” he added.

The CMA Boss pointed out that the program only targets all employees of capital markets intermediaries licensed under the provisions of part 5 of the Capital Markets Acts, who have direct dealings with clients and trading activities on behalf of clients and with less than ten years’ experience in the capital market industry.

The CISI’s international introduction to securities and investment program will be an industry recognized certificate for Kenya with intention to support adoption within the wider east African community (EAC) region.

The transition period for compliance with this requirement is a period of one year from January 4th this year.

The learning manual to be used for the employees will be expanded to include concepts and issues related to the (EAC) region as capital markets players increasingly operate across different markets.