BY SAM ALFAN.

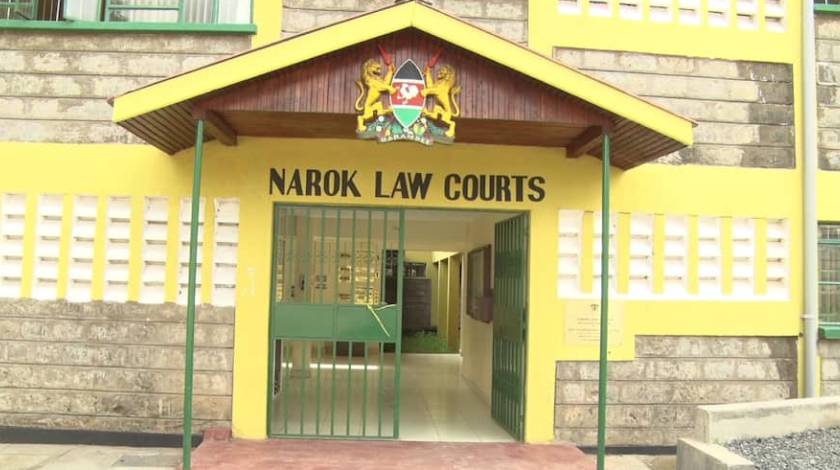

The High Court in Narok has ordered Occidental Insurance to pay a law firm of Sh6.7 million for damages after the insurer failed to provide the advocates with professional indemnity cover.

Justice Francis Gikonyo directed the insurer to pay Namunyak Nkurrunah Advocates for breach of contract for lost opportunity to make a commercial gain.

The judge said the law firm would have earned among other benefits but it wasn’t to be as the underwriter did not provide the firm with a professional indemnity cover for which, it had paid premiums. He said the loss is attributable to the failure.

Justice Gikonyo said this was proof of specific loss of value suffered, which was within the realm of general damages for breach of contract.

The judge added that in light of the specific damage proved, there is justification to move away from nominal damages to substantial damages for breach of contract or conduct of the appellants in the manner they handled the contract.

“I find that the facts here justify an award of substantial general damages over and above nominal damages. Be that as it may, the loss in opportunity to earn in the sum of Sh6,720,000 is reasonable in general damages for breach of contract herein. This is the global figure in damages which covers damages suffered including loss of other benefits which could have accrued under the contract for provision of legal services,” said Judge Gikonyo.

The law firm sued the insurance company seeking damages of Sh6.7 million, a refund of the Sh20,130 paid as premiums and a medical insurance cover for a period of two years.

Namunyak alleged that on or about 24th of August in the year 2017, Joseph Omwerema an agent of the Occidental Insurance visited their office at Mara house in Narok with the intention to sell a professional indemnity cover.

Following this encounter with the Omwerema, the law firm decided to take out a professional indemnity cover for the year 2018 for Sh12 million.

She further said that Omwerema sent her a proposal form which she filled out and from which Omwerema had calculated the premiums payable in the sum of Sh20,130 on 31st August 2017 which she paid via M-Pesa on 14th December 2017.

She further told the court that that she subsequently applied for a two year contract at Sagam Shepherds Medical center which required a professional indemnity cover of at least Sh. 10 million. See offer letter dated 8th of January 2018.

According to the lawyer, she received a policy document on 24th of January 2018 which to her shock covered only Sh. 2 million and not Sh. 12 million.

She then stated that on 26th of January 2018, Omwerema called her and informed her that she would be required to add an additional premium of Sh100,000 if she wanted to get a professional indemnity cover of Sh12 million.

In an email dated 26th of 2018, she wrote to the insurer giving two options that the insurance company performs its part in good time and offer a policy covering Sh12 million before the deadline for her to submit her bid for the contractual offer which was 30th January 2018 or cancel the policy and refund the premiums.

Through an email dated 29th January 2018, Omwerema canceled the policy issued to her and promised to refund the premiums she had paid.

After the cancellation of the policy document, she instituted a suit claiming she suffered special damages of Sh6.7 million.

The said amount she claims is the amount she would have gotten had she been awarded the contract by Sagam Shepherds Medical Center.