BY SAM ALFAN.

A secured creditor wants KCB appointed receiver manager Ramana Rao summoned over a report concerning the accounts of Mumias Sugar company, which he filed in court in January.

Vartox Resources Inc, one of the creditors of the ailing miller says Rao should appear in court and explain the books of accounts of the miller for the last two years.

In an application supported by rival West Kenya sugar company, Vartox also wants KCB group chief executive officer Joshua Waigara to appear in court for cross-examination.

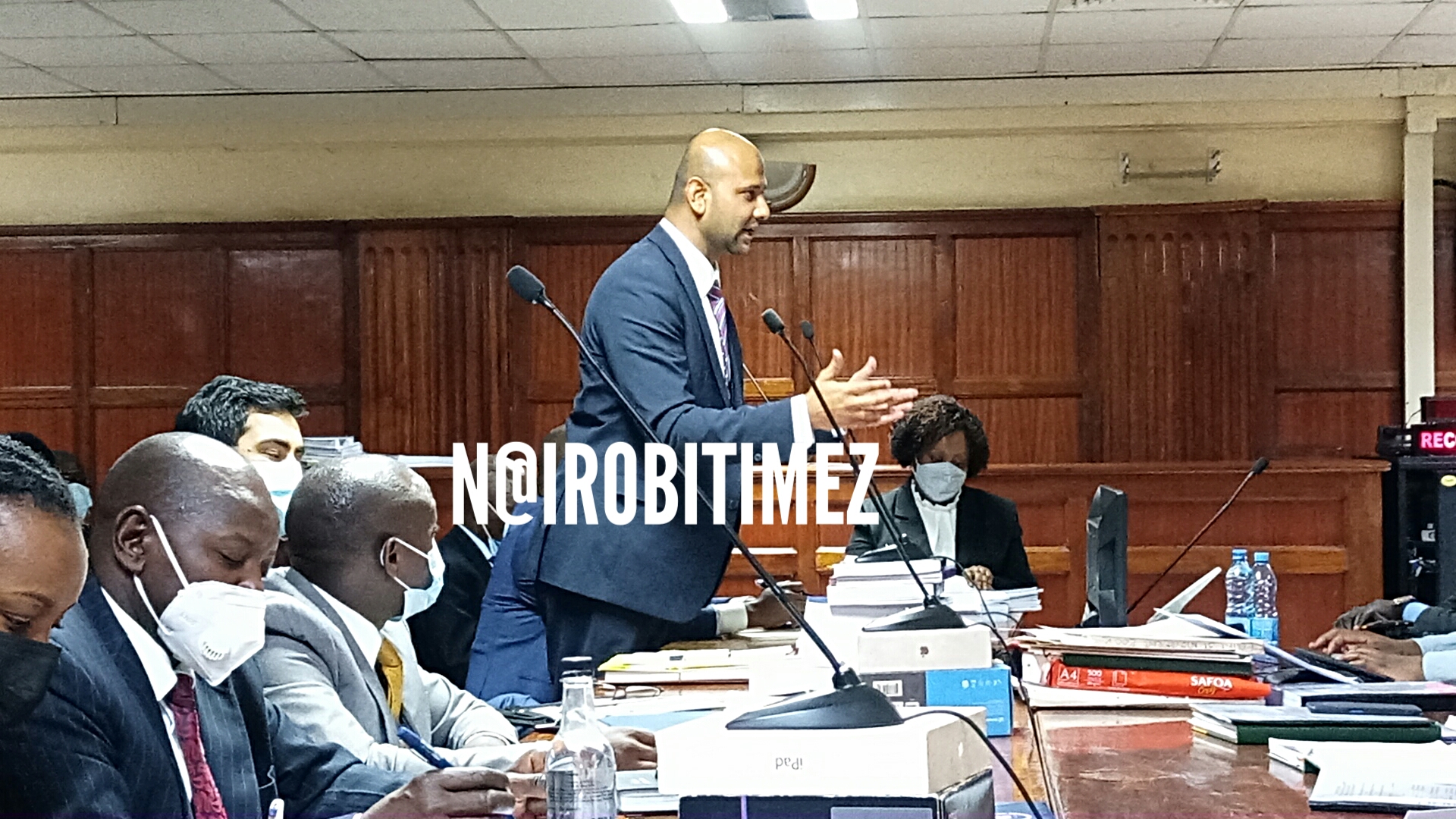

Through lawyer Ismael Abbas, Vartox also claimed that Rao has failed to produce a detailed valuation report as ordered by the court.

Abbas submitted that it has become necessary for Rao to be cross-examined on the inconsistencies, falsehood and coverup that he has engaged in during his time as receiver manager of Mumias Sugar.

He said Rao’s recent actions to lease the assets of Mumias Sugar to Sarrai Group Limited is littered with inconstancies.

“As the applicant’s application dated January 28, 2022 is under insolvency Act 2015, there is no provision for a viva voce hearing unlike in civil cases and the applicant does not have ant way to question Rao on the many inconsistencies to bring him to account for his law as administrator and receiver of Mumias,” said Abbas.

He further submitted that Rao has conducted himself in a manner meant to disenfranchise other creditors and stakeholders of Mumias Sugar, who have a debt portfolio exceeding Sh30 billion.

Abbas said the affairs of Mumias are of significant public interest as held by the court in a ruling on 19 November 2021.

Senior Counsel Paul Muite, who represents West Sugar supported the application saying Rao and KCB should come and explain the inconsistencies.

West Sugar has challenged the lease to Sarrai Group wondering how as the highest bidder, the miller missed out on the 20-year lease.

“He should not only be removed as an administrator, his conduct makes him unsuitable for a receiver or administrator,” Muite submitted.

Muite questioned what Rao is hiding since he has not availed the lease documents as requested

He urged the court to direct Rao to produce all documents supporting every entry that appears in his “abstract” filed with the court on January 18, 2022.

Muite said other than cross-examination, the two should also produce all documents including e-mails, letters and all correspondence exchanged with Rao, all board resolutions and approvals given to the administrator in relation to the leasing of Mumias’ assets to Sarrai Group.

Rao was given the nod to lease Mumias Sugar after receiving bids from several entities.

“Rao has leased the Company’s sugar factory and related assets to the lowest bidder in circumstances that point towards fraud since the 20-year lease executed will expire with Mumias continuing to be mired in debt with its assets potentially wasted and the only financial beneficiaries of the 20-year lease are the lowest bidder and the 1st Respondent. None of Mumias’ historical debts will ever get repaid in those 20 years,” added lawyer Abbas.

Rao allegedly discarded the highest bidder’s bid on the basis that it would not achieve the goals of the lease which was to turn around the Company to profitability.

Rao proceeded to award the bid to the lowest bidder after carrying out a technical evaluation but which losing bidders say was marred by opacity and serious anomalies.

The lawyer said Rao has not explained to Vartox or any of the other creditor how a bid of Sh6 billion over a period of 20 years will revive Mumias whose debts are in excess of Sh30 billion.

“In attempting to justify his flouting of the court orders, the 1st Respondent has relied on provisions of the repealed Companies Act that no longer exist in law. He has attempted to justify filing an abstract because Section 351 of the repealed Companies Act provided for the filing of abstracts,” lawyer Abbas added.

He added that Rao needs to be cross-examined on the basis for his reliance on repealed statutes which impact on his competency to act as a receiver considering he is unable to follow simple court directions and is relying on repealed statutes to carry out his duties.

He pointed out that Rao spent more than Sh 71 million paying lawyers and unnamed consultants and has also procured valuation reports after paying Sh21.9 million.

“Despite requests to him to supply details of these payments and the valuation reports, Rao has ignored these requests”.

Rao, he said, operated Mumias’ assets as though Mumias is his personal property.

“Apart from operating the Ethanol plant when he had no mandate to because KCB’s security did not extend to the Ethanol plant, he has refused to account for any of the proceeds from the operation of the Ethanol plant,” he said.

“Furthermore, he has borrowed money through an overdraft from KCB to the tune of Sh216 million in unclear circumstances, thereby further compounding Mumias’ woes and increasing its debt portfolioand the interest alone on the KCB overdraft amounts to Sh. 23 million, a figure that is more than 1 months’ lease rental that is being paid by the lowest bidder.

He said Rao should be crossexamined so that he can explain in detail the borrowings, what he has used the money for and how it impacted Mumias’ balance sheet as well as when the applicant’s outstanding debt will be cleared based on the current lease to the lowest bidder”, he added.